|

As we are fast approaching the 5 April 2021 fiscal year end, now is a good time to consider your circumstances for both general year-end tax planning as we well as if you are close to the 15 out of 20 tax year horizon and thus becoming deemed domicile for Income, Capital gains and Inheritance tax.

For those individuals that have become deemed UK domiciled as of 6 April 2017, as a result of being UK resident for 15 out of the last 20 tax years, there are various statutory reliefs available that can be extremely valuable and lead to significant tax advantages. Therefore, our advice is to consider these reliefs carefully as time limits exist on these provisions.

In addition to the above there are other actions you may want to take before the end of the tax year. Detailed below are the main issues to consider for all taxpayers at this time of year: –

Becoming Deemed Domiciled, resident for 7 out of the last 9 years or 12 out of the last 14 years

If you are approaching the date where you will be deemed domicile, having been UK resident for 15 out of the last 20 years, 12 out of the last 14 years or 7 out of the last 9 years, you may need to take urgent action before 05 April 2020.

Important note – Part tax years count as full tax years for this purpose.

Example 1 – Deemed Domiciled

“A” arrived in the UK in the tax year ended 5 April 2007 for the first time (the 2006/07 tax year), “A” will have been UK resident for 15 out of the last 20 years as of April 6 2021 and will become deemed domiciled for Income, Capital gains and Inheritance tax in the UK.

Example 2 – Resident 7 out of the last 9 years

“B” arrived in the UK in the tax year ended 5 April 2015 (the 2014/15 tax year),“B” will have been UK resident for 7 out of the last 9 years as of 06 April 2021 and will need to pay the £30k remittance basis charge in order to claim the remittance basis for the tax year 2021/22.

Excluded Property Trust

• Establish an excluded property trust and settle assets into it before you become deemed domicile for IHT. This is most relevant for people who are close to becoming deemed domicile in the UK for tax purposes. Although can be appropriate for individuals who have been in the UK for shorter periods for a variety of reasons.

• A trust can lead to Income, Capital gains and Inheritance tax benefits based on your circumstances.

If this is something that you would like to consider we would advise you contact us as soon as possible, as typically at least one month lead time is required to consider and establish such an engagement.

Rebasing election

• If you have paid the remittance basis charge in any of the previous years you can rebase your foreign assets as of 5 April 2017. If you have not paid the RBC, there may still be an opportunity to rectify this.

• The assets must have been located outside the UK throughout the period from 16 March 2016 or, if later, the date you acquired the asset, to 5 April 2017.

• If necessary it may be possible to make an election for a prior year and claim the remittance basis and pay the charge in order to enable the rebasing opportunity

• Please note this election is not applicable if you become deemed domiciled after 6 April 2017

• In addition you will be able to make tax-free remittances of any gains realised on disposals on non-UK assets after 5 April 2017 to the extent such gains are attributable to the pre-April 2017 period depending on your residence position prior to April 2017.

Business Investment relief

• This allows the remittance of income taxable on the remittance basis.

• It is possible to invest into EIS or SEIS companies using this relief.

• It is possible to invest into your own business.

• It is possible to make investments into a property rental business.

• We are able to obtain HMRC advance clearance on transactions, thus attaining certainty on the non-taxation of remittances to the UK

Other Opportunities

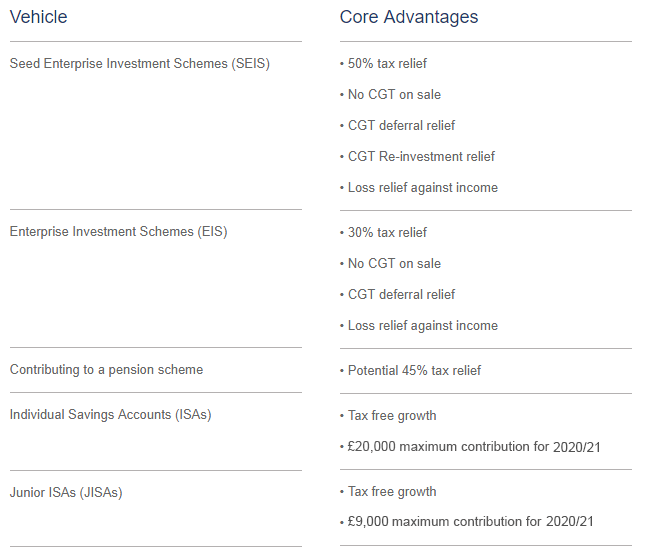

If you are interested in further tax planning then the following tax-efficient investments are also available.

Please do not hesitate to contact our team here at Frontier Group and we are happy to arrange a consultation.

Frontier Fiscal Services Limited |