“For The 99.5% Act”

The recent introduction of Senator Bernie Sanders’s proposed tax reform bill, the “For the 99.5% Act,” has proven to bring the possibility of unprecedented changes to tax and estate planning.

Examples of these changes include:

- – Reducing existing federal estate and gift tax exemptions

- Increasing estate tax rates

- Limiting lifetime transfer strategies

- Imposing new rules and regulations on certain types of commonly used trusts.

Due to the uncertainty of outcome of this proposed legislation, taxpayers may be pre-empted to make changes to their estate planning.

Federal estate and gift tax exemption

At present, federal estate and gift tax exemption is set at $11.7 million per individual and $23.4 million per married couple.

- This exemption may be applied by individuals to gifts made during the taxpayer’s lifetime or to transfers made at the taxpayer’s death.

- The exemption may also be applied partially to lifetime transfers and the remainder to transfers at death.

If implemented, the “For the 99.5% Act” proposes the following changes:

- The federal gift tax exemption amount would be reduced to $1 million per individual.

- The federal estate tax exemption would be reduced to $3.5 million per individual and $7 million for married couples.

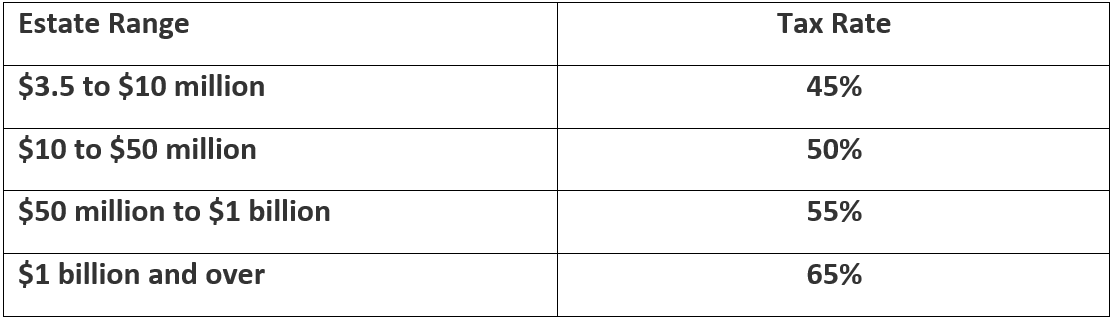

- There would be an increase in the progressive estate tax rates for estates exceeding $3.5 million:

- Annual gifting that is tax exempt would be limited to certain transfers, including transfers to trusts and to certain family entities.

- Valuation discounts on the transfer of certain assets.

- The effectiveness of grantor trusts would be limited.

- Grantor Retained Annuity Trusts (GRATs), a longstanding vehicle for highly favourable lifetime transfers, would also face new restrictions.

If the “For the 99.5% Act,” is enacted it would not apply to trusts and transfers created prior to enactment. It may therefore be wise for high-net-worth individuals to consider proactive next steps to address these potential limitations before they become law.