As we are fast approaching the 5 April 2025 fiscal year end, now is a good time to consider your circumstances for general year-end tax planning for UK purposes. Particularly of note are certain changes for the treatment of non-UK domiciled individuals.

There are actions you may want to take before the end of the tax year. Detailed below are the main issues to consider for all taxpayers at this time of year. Note that for US persons there may be further considerations: –

Changes to the UK Non-Dom rules

From 6 April 2025 the non-dom regime will officially come to an end, being replaced with a residency-based system whereby an individual who is resident for 10 of the last 20 years will be considered a “Long Term Resident”.

The remittance basis of taxation will no longer apply and this is being replaced by a 4 year foreign income and gain exemption, where individuals qualify, along with a temporary repatriation facility for individuals that previously benefited from the remittance basis. UK residents that do not qualify for the 4 year income and gains exemption will move to a worldwide basis of UK taxation from 6 April 2025.

Individuals that have been claiming the remittance basis of taxation and will move to worldwide taxation on 6 April 2025 should consider a review of their affairs and foreign investments to ensure this is efficient for UK purposes moving forward.

Offshore trust arrangements should also be reviewed for any required actions before 6 April 2025.

For further details on the upcoming changes, please see our website article Here

Business Investment relief

- This allows the remittance of income taxable on the remittance basis.

- It is possible to invest into EIS or SEIS companies using this relief.

- It is possible to invest into your own business.

- It is possible to make investments into a property rental business.

- We are able to obtain HMRC advance clearance on transactions, thus attaining certainty on the non-taxation of remittances to the UK

Note that Business Investment relief is due to expire for any new investments on 5 April 2028.

Pensions

Many individuals utilise pensions as part of their overall tax planning strategy. At the end of the UK tax year, it is worth reviewing your pension contributions for the year and consider any optimisation as well as ensure you have not overstepped the mark, especially since HMRC have drastically reduced the amounts from historic levels that are relievable for tax for higher earners. Some of the key things to note are as follows:

- You are entitled to pay in up to £60,000 tax free per year, but this is tapered once your income exceeds £260,000 to a minimum of £10,000 allowance when your income exceeds £360,000.

- Unused allowances are carried forward for three years.

- Tax relief for pension contributions is claimed on your tax return where contributions are made net of tax.

- If you or your employer overpays into your pension you could be liable to an additional tax charge.

- From 6 April 2023 the lifetime allowance no longer applies.

- Note that the Government intends to include pensions in a taxpayers estate for UK Inheritance Tax from 6 April 2027.

It is advisable to review your position to avoid any pitfalls and optimise where necessary.

US mutual funds and other non-UK funds

Those individuals that will newly become subject to UK tax on a worldwide basis from 6 April 2025 should review their offshore investments.

- It is important to review your investment portfolio, there may be changes required within your portfolio to ensure that your investments are UK efficient. For example, the sale of a US mutual fund (non-reporting fund for UK purposes) leading to a gain, may be liable to income tax (45%) on such income gains, as well as the fact that other losses from other mutual funds may not be allowable against such gains. It is imperative to review your portfolio in such circumstances.

- There may be other tax mitigation strategies that can be enacted before the assets become liable to UK taxation.

Inheritance Tax and US Estate tax implications

UK Inheritance Tax (IHT) is assessed on the estate of a deceased individual as well as certain gifts you make whilst you are alive.

From 6 April 2025 the non-dom regime will officially come to an end, being replaced with a residency based system whereby an individual who is resident for 10 of the last 20 years will be considered a “Long Term Resident” and liable to UK Inheritance Tax. Note that in some cases tax treaty relief may apply and will need to be reviewed.

The US estate and gift tax system works by providing each US domiciled individual a Lifetime allowance of $13.99m (2025) which can be used at death, although is reduced for taxable lifetime gifts. The annual tax-free gift exclusion per done is $19,000 (2025). Note that the current estate exemption is due to lapse on the 31st of December 2025 and will revert to a lower amount unless the provisions are extended.

Both systems need to be navigated to ensure effective planning, however with the generous US lifetime allowance there may be no tax liability of a gift for US purposes, however there are certain filing requirements if a US person makes a gift of more than $19k or receives a gift from a non-US person.

- Broadly, each UK individual has a nil rate IHT allowance of £325,000 (this can be increased to £500,000 where the estate includes your primary residence). Assets in the estate in excess of the tax free allowance are generally charged at 40%.

- Effective planning may include setting up a trust, gifting assets, changing the composition of the estate to include exempt assets.

- Additionally certain gifts can be made tax free each year.

UK Inheritance Tax reliefs for Agricultural Property Relief and Business Property Relief (APR/BPR) are set to be restricted from 6 April 2026.

Family Investment Company (FIC)

A family investment company (FIC) is a private limited company which is used as a long-term investment vehicle. It Can provide an effective way to shelter income and assets from higher rates of taxation and Inheritance Tax. Some of the key benefits of an FIC are as follows:

- The FIC can retain profits for investment rather than those profits being drawn out and being subject to higher rates of personal tax in the hands of the shareholders.

- The FIC can be used as an effective tool to manage the passing down of assets to future generations in a controlled and tax efficient manner e.g. gifting non-voting shares to mature offspring in order to retain control of assets, whilst allowing assets to pass down to children.

Before an FIC is implemented, one must carefully consider if it is an appropriate strategy for you and your family’s long-term circumstances. I would advise that before implementing such a strategy you must seek tax and possibly legal advice.

Excess Foreign tax credits (FTCs) – For US Taxpayers

Excess FTCs arise due to the fact UK tax rates are higher that US tax rates, a US person is able to carry these excess credits forward for a period of 10 years. These excess credits can be useful in a number of scenarios, not limited to the opportunities raised in this article.

In conjunction with much of the planning detailed above and below, a review of your excess FTCs must be carried out to understand the impact from both a UK and US tax perspective.

For example, you may generate a UK tax refund by making an EIS investment, however you could be in scenario where you have to pay some or all of the refund back to the IRS, due to a lack of UK tax paid that year or excess FTCs.

Investors Relief

Investors’ Relief reduces the amount of Capital Gains Tax on a disposal of shares in a trading company that is not listed on a stock exchange. It applies to shares that are issued on or after 17 March 2016 that are disposed of on or after 6 April 2019, as long as the shares have been owned for at least 3 years up to the date of disposal. It is not usually available if you or someone connected with you is an employee of the company. Qualifying capital gains for each individual are subject to a lifetime limit of £10 million.

If you’re entitled to Investors’ Relief, qualifying gains up to the lifetime limit applying at the time you make your disposal, will be charged to CGT at the rate of 10%.

The conditions for qualification are broadly:

• They are ordinary shares in the company

• You subscribed for them in cash and they were fully paid up when issued

• The company is a trading company or the holding company of a trading group

• None of the company’s shares are listed on a stock exchange

• Neither you nor any person connected with you is an employee of the company or of a company connected with it

It is essential that a detailed review of the investment is undertaken to confirm qualification for this relief.

Other Opportunities

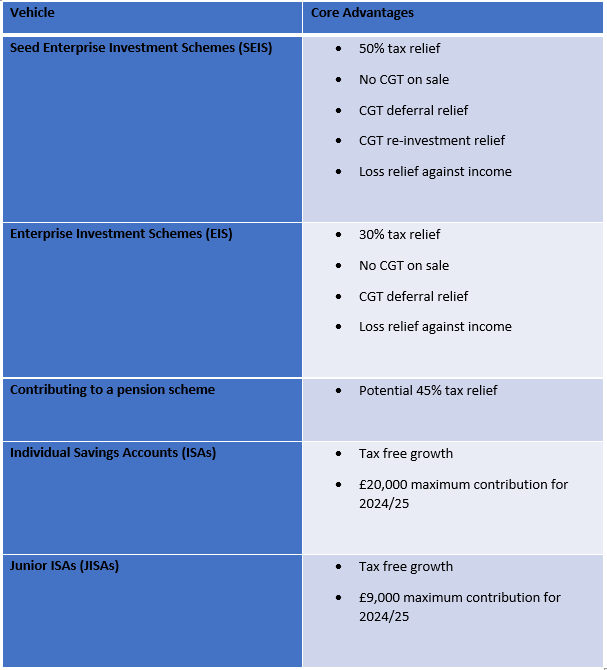

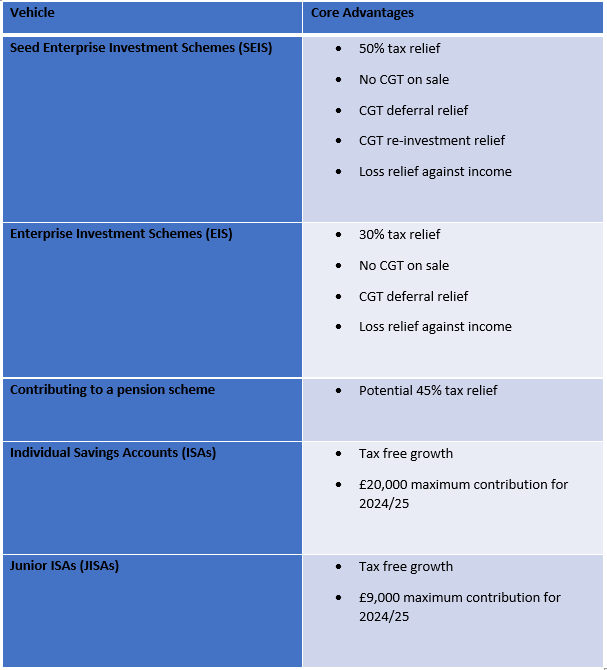

If you are interested in further tax planning, then the following tax-efficient investments are also available. If you are considering any tax planning opportunities for the future, please get in touch. We have provided an overview below but please note that there are qualifying conditions and limits on these investments. In addition, clients that are US citizens may need further considerations.

Please do not hesitate to contact our team here at Frontier Group and we are happy to arrange a consultation.

Frontier Fiscal Services Limited