The US/UK estate and gift tax treaty was implemented to avoid double taxation of gifts and estates of US citizens and domiciles and UK domiciles by allowing only one country to impose its tax and the other to allow a credit against the taxes already paid.

However, uncertainty has arisen regarding this tax treaty due to the potential changes our government may soon implement. Below, we have outlined the key points, upcoming changes and potential consequences which may occur in the near future:

Key points:

- Domicile Status:

- • US citizens residing in the US and domiciled in the UK are ‘domiciled’ in both countries for tax purposes. ‘Tie-breaker’ provisions in the Treaty determine primary taxing rights based on residency and nationality.

- US Citizens’ Tax Treatment:

- • If a US citizen is not a UK national and has not been a UK tax resident for 7 of the last 10 years, they are treated as ‘treaty domiciled’ in the US. This status limits exposure to UK Inheritance Tax (IHT) to UK real estate and certain business properties.

- UK Nationals:

- • If a US citizen is also a UK national, the UK retains taxing rights over all UK property, regardless of treaty domicile status.

- Treaty Protected Trusts:

- • US ‘treaty domiciled’ individuals who are not UK nationals can establish ‘treaty protected trusts’ to shield assets from UK IHT. Assets in these trusts are exempt from UK IHT if the settlor was treaty domiciled in the US at the time of settlement.

- Potential for Renunciation:

- • Some individuals may consider renouncing UK nationality to benefit from treaty provisions, but this requires careful consideration of implications.

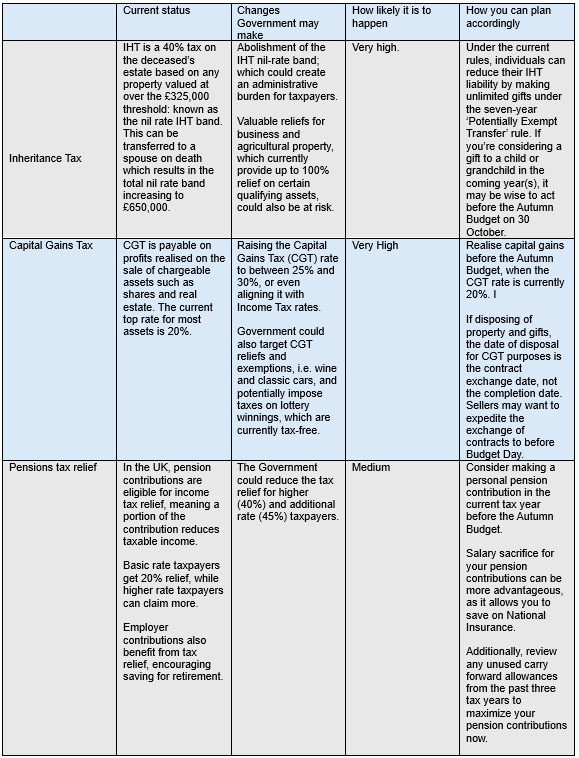

Upcoming changes to the UK’s IHT Regime:

- New IHT Regime (Effective 6 April 2025):

- • UK IHT liability will shift from domicile status to residence status.

-

- • Residents in the UK for 10 years will be liable for IHT on worldwide assets, remaining liable for 10 years after leaving the UK.

- Impact on Trusts:

- • The IHT position of trust assets will be determined by the settlor’s residence at the time of the IHT charge, not their domicile at the time of settlement.

Upcoming changes to the UK’s IHT Regime:

- Interaction with Treaty Provisions:

- • Unclear how Treaty domicile-based provisions will align with the new residence-based IHT system.

- Potential Government Actions:

- • The UK government may amend legislation to align treaty concepts with the new residence test, possibly affecting ‘treaty protected trusts.’

-

- • Amendments to the Treaty may require re-negotiation, potentially preserving the current protections for the medium-long term.