The Global Intangible Low-Taxed Income (GILTI) Regime

The Global Intangible Low-Taxed Income (‘GILTI’) regime, enacted as part of Congress’s 2017 tax reform initiative, effectively subjects any US citizen, green card holder, and other US tax resident (a ‘US Person’) to US income tax on the worldwide earnings of any non-US corporation (i) in which the US Person himself or herself holds a material proportion of the shares, and (ii) which is majority-owned or controlled by one or more US Persons, each of whom owns a material proportion of such shares.

The GILTI tax applies only to ‘US Shareholders’ of ‘Controlled Foreign Corporations’ (‘CFCs’). A US Shareholder is a US Person, US corporation, or other US entity that owns or is treated as owning at least 10 percent of the stock of a non-US corporation by voting power or value.

Determining GILTI Tax Liability

Taxpayers with GILTI face U.S. taxation that would otherwise be applied at the new statutory corporate tax rate of 21 percent if corporates and ordinary federal rates if individuals. The law’s structure curtails the impact of this provision, however: Through 2025, taxpayers may claim a deduction equal to the amount of 50 percent of GILTI(not available to individuals although certain elections can be made to mitigate this), and 37.5 percent thereafter. Accordingly, taxpayers reporting GILTI income face effective U.S. tax rates on that income of 10.5 percent through 2025 and 13.125 percent thereafter. These deductions are limited under certain circumstances.

To the extent that GILTI is earned overseas, U.S. foreign subsidiaries may have paid foreign tax on that income. Consistent with other elements of the TCJA and prior tax law, taxpayers may claim credits against foreign taxes paid, but the TCJA limits foreign-tax credits (FTC) against GILTI income to 80 percent of taxes paid. This limitation has the effect of increasing the effective tax rate that firms face compared to if they could claim credits for all of their paid foreign taxes.

GILTI By Example

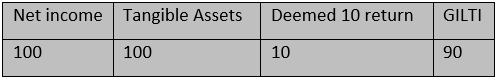

For the purposes of this example, assume the owner is a US individual and is the sole shareholder of an entity operating out of a foreign country that has a 10 percent tax rate. For this example, assume the foreign entity is essentially earning income ($100 in this example) with $100 intangible assets (essentially the office equipment). In this case, the excess over the 10 percent return on $100 in office equipment would equal the GILTI amount that the individual would need to report this on his/her tax return.

Hypothetical Firm’s GILTI Income

The individual would then report this income on his or her U.S. tax return. There is no 50 percent deduction unless a specific election is made for individuals. The income would be taxable at ordinary federal rates potentially 37%.

Therefore, as can be seen, by this example, this can be very onerous and careful planning is required to ensure over-burdensome tax liabilities are avoided.