As we are fast approaching the 5 April 2024 fiscal year end, now is a good time to consider your circumstances for general year-end tax planning for UK purposes. Particularly of note are certain milestones for non-UK domiciled individuals.

There are actions you may want to take before the end of the tax year. Detailed below are the main issues to consider for all taxpayers at this time of year. Note that for US persons there may be further considerations: –

Becoming Deemed Domiciled, resident for 7 out of the last 9 years or 12 out of the last 14 years

If you are approaching the date where you will be deemed domicile, having been UK resident for 15 out of the last 20 years, 12 out of the last 14 years or 7 out of the last 9 years, you may need to take urgent action before 05 April 2024.

Important note – Part tax years count as full tax years for this purpose.

Example 1 – Resident 7 out of the last 9 years

“A” arrived in the UK in the tax year ended 5 April 2018 (the 2017/18 tax year),”A” will have been UK resident for 7 out of the last 9 years as of 06 April 2024 and will need to pay the £30k remittance basis charge in order to claim the remittance basis for the tax year 2024/25.

Example 2 – Resident 12 out of the last 14 years

“B” arrived in the UK in the tax year ended 5 April 2013 (the 2012/13 tax year),”B” will have been UK resident for 12 out of the last 14 years as of 06 April 2024 and will need to pay the £60k remittance basis charge in order to claim the remittance basis for the tax year 2024/25.

Actions for Examples 1 & 2 – Review foreign income to assess whether the remittance basis is still favourable. Review offshore assets for UK compliance.

Example 3 – Deemed Domiciled

“C” arrived in the UK in the tax year ended 5 April 2010 (the 2009/10 tax year), “C” will have been UK resident for 15 out of the last 20 years as of 06 April 2024 and will become deemed domiciled for Income, Capital gains and Inheritance tax in the UK for the 2024/25 year onwards.

Actions for example 3 – Review inheritance tax position before deemed domicile status comes into effect. Review offshore assets for UK compliance.

Excluded Property Trust

• Establish an excluded property trust and settle assets into it before you become deemed domicile for IHT. This is most relevant for people who are close to becoming deemed domicile in the UK for tax purposes. Although can be appropriate for individuals who have been in the UK for shorter periods for a variety of reasons.

• A trust can lead to Income, Capital gains and Inheritance tax benefits based on your circumstances.

If this is something that you would like to consider we would advise you contact us as soon as possible, as typically at least one month lead time is required to consider and establish such an engagement.

Business Investment relief

• This allows the remittance of income taxable on the remittance basis.

• It is possible to invest into EIS or SEIS companies using this relief.

• It is possible to invest into your own business.

• It is possible to make investments into a property rental business.

• We are able to obtain HMRC advance clearance on transactions, thus attaining certainty on the non-taxation of remittances to the UK

Pensions

Many individuals utilise pensions as part of their overall tax planning strategy. At the end of the UK tax year, it is worth reviewing your pension contributions for the year and consider any optimisation as well as ensure you have not overstepped the mark, especially since HMRC have drastically reduced the amounts from historic levels that are relievable for tax for higher earners. Some of the key things to note are as follows:

• You are entitled to pay in up to £60,000 tax free per year, but this is tapered once your income exceeds £260,000 to a minimum of £10,000 allowance when your income exceeds £360,000.

• Unused allowances are carried forward for three years.

• Tax relief for pension contributions is claimed on your tax return where contributions are made net of tax.

• If you or your employer overpays into your pension you could be liable to an additional tax charge.

• From 6 April 2023 the lifetime allowance no longer applies – this was previously £1.073m

I would advise that you should review your position to avoid any pitfalls and optimise where necessary.

Basis Period Reform

The Finance Act 2022 introduced changes to how trading profits are allocated and taxed. The reform aims to allocate profits based on a time apportionment to the tax year, rather than the accounting date.

This adjustment impacts self-employed individuals and partners in trading partnerships if their accounting periods do not align with the tax year (considered aligned if falling between 31 March and 5 April). The changes will be effective from the 2024/25 tax year, with transitional rules in place for 2023/24.

Special rules apply for the first year of a trade – where the individual will be allocated profits from when the trade commenced up to the end of the tax year.

Individuals and partnerships may evaluate the benefits of aligning their accounting period with the tax year to potentially save on accounting and associated costs.

In cases where additional liabilities arise in the transitional year, there is an option for potential relief by spreading the additional profit over a 5-year period.

US mutual funds and other non-UK funds

If you are approaching 7 years or 15 Tax years since you arrived in the UK, the remittance basis of taxation may not be the most efficient option or no longer available after 15 years. This means that your non-UK income may be brought into the scope of UK taxation. This can lead to very negative tax Implications for UK tax purposes, if you have not reviewed your investment portfolio and taken any relevant action. Some keys issues to note:

• It is important to review your investment portfolio, there may be changes required within your portfolio to ensure that your investments are UK efficient. For example the sale of a US mutual fund (non-reporting fund for UK purposes) leading to a gain, may be liable to income tax(45%) on such income gains, as well as the fact that other losses from other mutual funds may not be allowable against such gains. It is imperative to review your portfolio in such circumstances.

• There may be other tax mitigation strategies that can be enacted before the assets become liable to UK taxation.

It is essential that you review your portfolio, especially if you are nearing the end of the 7 year or 15 tax year window.

Inheritance Tax and US Estate tax implications

UK Inheritance Tax (IHT) is assessed on the estate of a deceased individual as well as certain gifts you make whilst you are alive, however, Domicile status can have a significant impact on the exposure to UK Inheritance Tax.

The US estate and gift tax system works in a different way, providing each individual a Lifetime allowance of $13.61m (2024) which can be used at death, although is reduced for taxable lifetime gifts. The annual tax-free gift exclusion per donee is $18,000 (2024). Note that the current estate exemption is due to lapse at 31 December 2025 and will revert to a lower amount unless the provisions are extended.

Both systems need to be navigated to ensure effective planning, however with the generous US lifetime allowance there may be no tax liability of a gift for US purposes, however there are certain filing requirements if a US person makes a gift of more than $18k or receives a gift from a non-US person.

• Broadly, each UK individual has a nil rate IHT allowance of £325,000 (this can be increased to £500,000 where the estate includes your primary residence). Assets in the estate in excess of the tax free allowance are generally charged at 40%.

• Effective planning may include setting up a trust, gifting assets, changing the composition of the estate to include exempt assets.

• Additionally certain gifts can be made tax free each year.

Family Investment Company (FIC)

A family investment company (FIC) is a private limited company which is used as a long-term investment vehicle. It Can provide an effective way to shelter income and assets from higher rates of taxation and Inheritance Tax. Some of the key benefits of an FIC are as follows:

• The FIC can retain profits for investment rather than those profits being drawn out and being subject to higher rates of personal tax in the hands of the shareholders.

• The FIC can be used as an effective tool to manage the passing down of assets to future generations in a controlled and tax efficient manner e.g. gifting non-voting shares to mature offspring in order to retain control of assets, whilst allowing assets to pass down to children.

Before an FIC is implemented, one must carefully consider if it is an appropriate strategy for you and your family’s long-term circumstances. I would advise that before implementing such a strategy you must seek tax and possibly legal advice.

Excess Foreign tax credits (FTCs) – For US Taxpayers

Excess FTCs arise due to the fact UK tax rates are higher that US tax rates, a US person is able to carry these excess credits forward for a period of 10 years. These excess credits can be useful in a number of scenarios, not limited to the opportunities raised in this article.

In conjunction with much of the planning detailed above and below, a review of your excess FTCs must be carried out to understand the impact from both a UK and US tax perspective.

For example, you may generate a UK tax refund by making an EIS investment, however you could be in scenario where you have to pay some or all of the refund back to the IRS, due to a lack of UK tax paid that year or excess FTCs.

Investors Relief

Investors’ Relief reduces the amount of Capital Gains Tax on a disposal of shares in a trading company that is not listed on a stock exchange. It applies to shares that are issued on or after 17 March 2016 that are disposed of on or after 6 April 2019, as long as the shares have been owned for at least 3 years up to the date of disposal. It is not usually available if you or someone connected with you is an employee of the company. Qualifying capital gains for each individual are subject to a lifetime limit of £10 million.

If you’re entitled to Investors’ Relief, qualifying gains up to the lifetime limit applying at the time you make your disposal, will be charged to CGT at the rate of 10%.

The conditions for qualification are broadly:

• They are ordinary shares in the company

• You subscribed for them in cash and they were fully paid up when issued

• The company is a trading company or the holding company of a trading group

• None of the company’s shares are listed on a stock exchange

• Neither you nor any person connected with you is an employee of the company or of a company connected with it

It is essential that a detailed review of the investment is undertaken to confirm qualification for this relief.

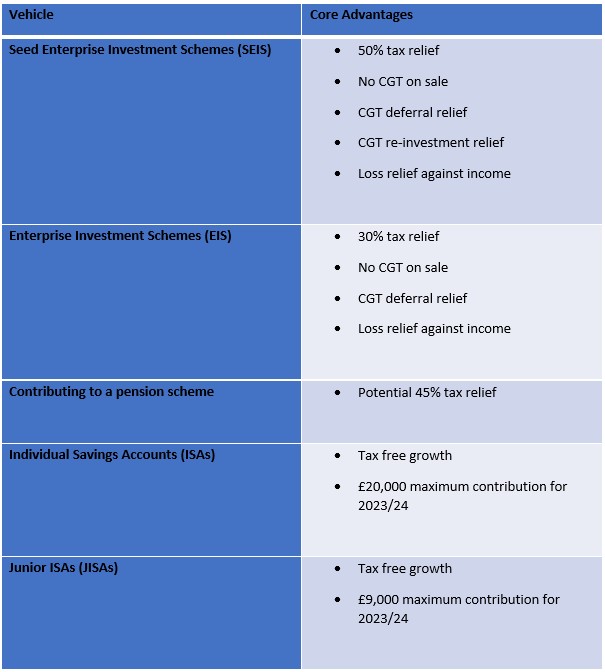

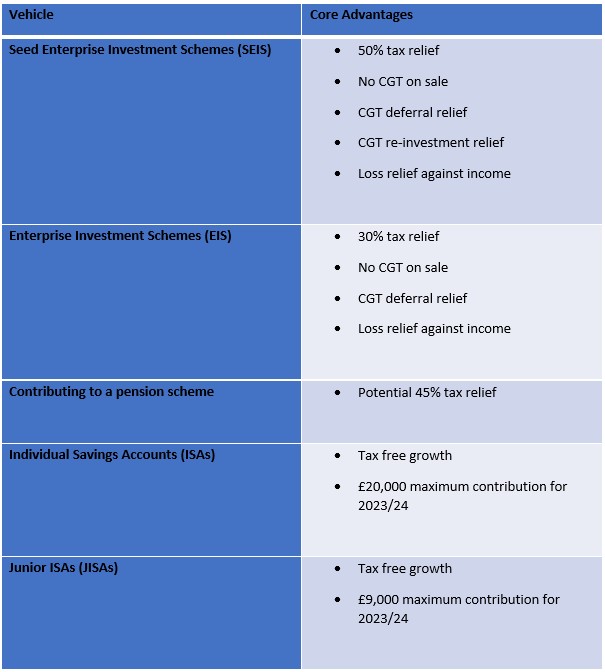

Other Opportunities

If you are interested in further tax planning, then the following tax-efficient investments are also available. If you are considering any tax planning opportunities for the future, please get in touch. We have provided an overview below but please note that there are qualifying conditions and limits on these investments. In addition, clients that are US citizens may need further considerations.

Please do not hesitate to contact our team here at Frontier Group and we are happy to arrange a consultation.

Frontier Fiscal Services Limited